In banking, uptime is not just an SLA; it is of far greater importance. I’ve seen firsthand how every digital interaction, from a simple fund transfer to a high-value transaction, depends on the resilience of the underlying infrastructure.

Over the years, digital and mobile banking have completely changed what banks expect from their data center partners. Sure, you can host servers, but what’s equally important is if you can ensure real-time availability, regulatory compliance, and cybersecurity at all times.

At CtrlS, I lead operations across Tier IV, fault-tolerant, and audit-ready data centers built specifically to meet the needs of global banking institutions. Our approach combines rigorous engineering with disciplined operations to maintain uninterrupted trust.

In this piece, I want to share how we at CtrlS build and manage resilient data centers. And mind you, technology is one part of it; there’s so much more required in terms of compliance culture, accountability, and operational precision.

Why Banking Demands a Distinct Data Center Philosophy

I’ve worked across multiple industries, but banking is in a class of its own when it comes to operational demands. Every byte of data we handle is bound by strict frameworks (RBI, PCI DSS, GLBA, SOX, GDPR), each carrying significant compliance implications.

The tolerance for latency is near zero, as even a few seconds of delay can affect customer confidence and financial integrity. Data residency and sovereignty requirements further shape where and how infrastructure is built. What makes banking operations even more complex is the evolving threat possibilities (AI-driven attacks, insider risks, and the need for zero-trust security models).

Over time, I’ve seen clients shift their priorities from basic uptime metrics to a deeper focus on audit readiness, transparency, and cyber resilience. To serve this sector effectively, we must think beyond redundancy; we must embed compliance into every process.

Redefining Resilience: The CtrlS Way

When I think about resilience, I don’t limit it to infrastructure. True resilience is built into the design, the people, and the processes that run a data center.

At CtrlS, my approach has always been to engineer systems that anticipate failure and not just react to it. That philosophy guides every operational decision we make.

Compliance as a Culture, Not a Checklist

I have seen institutions treat compliance like a burden. And when the majority thinks this way, you can go one step ahead with it and make it your differentiator. It’s how our clients measure trust and how we measure ourselves.

At CtrlS, compliance isn’t something we prepare for once a year; it’s embedded into our daily operations. We treat it as a continuous state of readiness, not an event. Our banking clients depend on us to maintain the highest levels of integrity and transparency, which means our systems must always be audit-ready.

We adhere to strict frameworks such as RBI, PCI DSS, ISO 27001, and SOC 2 Type II. These are non-negotiable for BFSI operations. Every process, from data access to incident reporting, is aligned with these standards.

We maintain audit-readiness 365 days a year through centralized documentation, continuous monitoring, and automated evidence capture. Our infrastructure also fully supports data sovereignty and localization, ensuring compliance with India’s financial regulatory mandates without compromising performance.

Most importantly, we build a compliance mindset across every level of the organization. From onboarding onwards, employees understand not just the procedures but the reasoning behind them. This shared accountability ensures that compliance is not an external requirement but a part of who we are

Managing Complexity at Scale

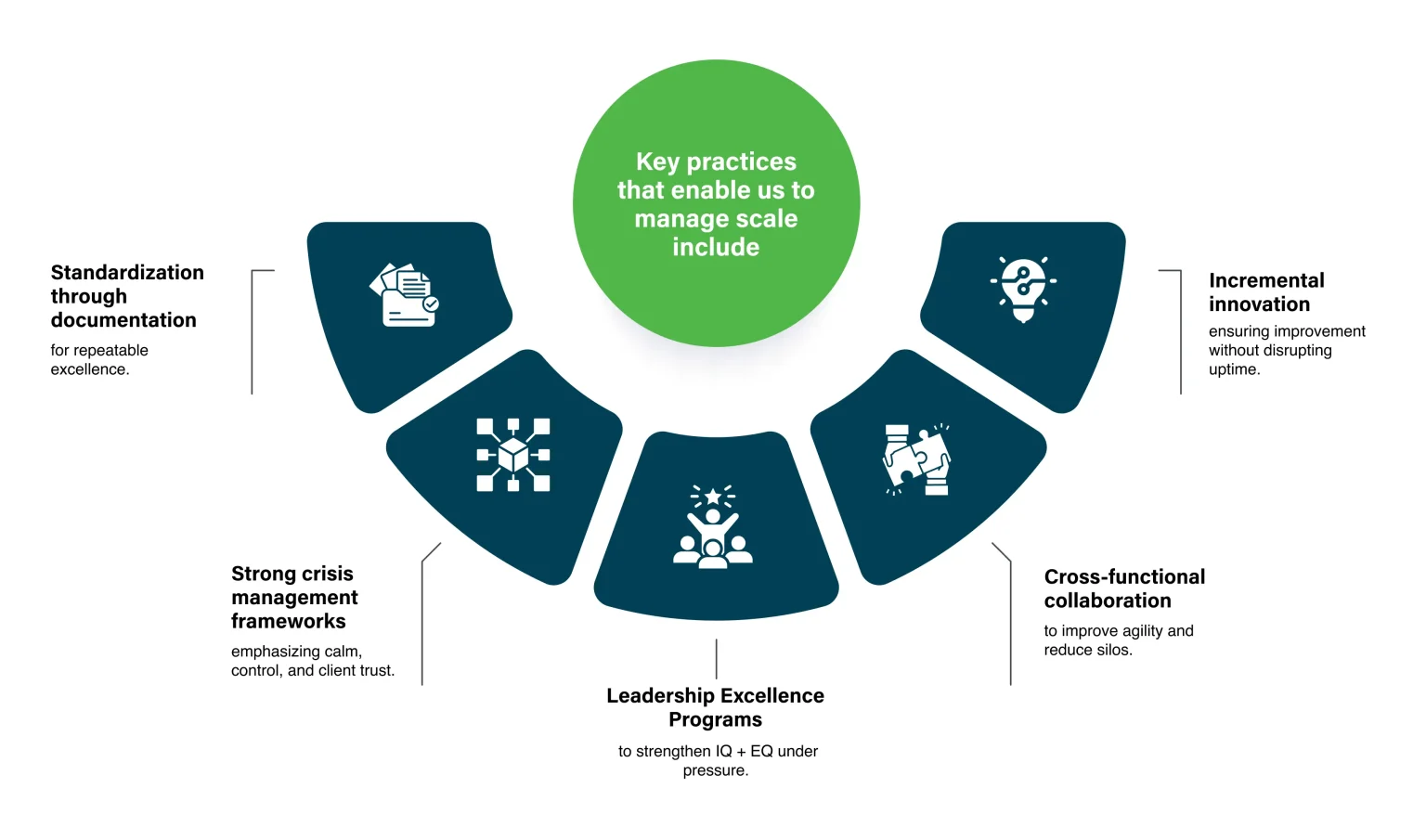

When you operate multiple data centers across regions, it requires more than technical capability. It demands discipline, consistency, and leadership depth.

I’ve learned that standardization is the foundation of scale. Every CtrlS facility, regardless of geography, operates on the same modular Standard Operating Procedures (SOPs). These are not static documents but living frameworks that evolve with every audit, review, and incident. This consistency allows us to deliver the same reliability and performance whether the client is in Mumbai, Singapore, or Dallas.

In times of crisis, leadership defines outcomes. My philosophy is simple: stay calm, support the ground team, and communicate with full transparency. I believe operational excellence comes from empowering people, not micromanaging them.

To sustain this, we invest heavily in leadership training, helping our teams build both technical acumen and emotional intelligence to manage high-pressure situations effectively.

Security and Trust: The Dual Pillars of BFSI Operations

I’ve always believed that security cannot be an afterthought. It has to be built into the foundation. At CtrlS, we follow a security-by-design approach, ensuring that protection starts at the physical layer and extends through every level of the digital environment. From access control and surveillance to encryption and network segmentation, every layer is designed to minimize exposure and strengthen defense.

Our zero-trust architecture ensures that no one, internal or external, has implicit access. We enforce strict role-based permissions, multi-factor authentication, and continuous monitoring to detect and isolate anomalies in real time. The threats have changed dramatically, and we’re already preparing for emerging risks through behavioral analytics and AI-based threat prediction.

For me, transparency is the ultimate expression of trust. We maintain independent certifications, undergo frequent third-party audits, and share reports openly with clients. This not only reinforces accountability but also builds long-term confidence.

The Future of Banking Data Centers

The next phase of banking infrastructure will be defined by agility and intelligence. I believe the traditional boundaries between on-premise, cloud, and edge will continue to blur as banks seek to balance control with flexibility. The future is hybrid and multi-cloud, where workloads move seamlessly between private and public environments based on security, cost, and performance needs.

At the same time, AI and edge computing are transforming how financial institutions manage risk, detect fraud, and deliver personalized experiences in real time. As transactions and analytics shift closer to the user, the data center must evolve to support faster decision-making and lower latency.

We’re also moving toward automation-led operations, where predictive insights reduce manual intervention and speed up root-cause analysis. For me, this is not about replacing human intelligence but augmenting it.

At CtrlS, our focus is on building intelligent, adaptive infrastructure that supports next-generation BFSI workloads:

Building Resilience Through People and Purpose

For me, leadership begins with people. I follow the principle of servant leadership (people before everything else). In a zero-downtime environment, teams operate under constant pressure, and my role is to keep them motivated, focused, and supported.

Operational excellence isn’t about reacting faster; it’s about planning smarter. I often say that achieving 100% uptime requires 75% proactive preparation, anticipating issues before they occur and empowering teams to act decisively when they do.

My leadership approach is built on precision, trust, and accountability. I believe in giving teams ownership because accountability creates confidence. I also remind my teams to respect the machine, understand it deeply, maintain it rigorously, and it will perform reliably.

If I had to describe CtrlS’s culture in one word, it would be “entrepreneurial.” Every individual here takes ownership of outcomes, not just operations, and that’s what makes our organization resilient.

Conclusion: Banking on Resilience

Resilient and compliant data centers are the foundation of digital banking trust. For me, it’s never been just about infrastructure; it’s about building systems that uphold integrity, ensure compliance, and deliver uninterrupted performance every second of the day.

At CtrlS, our mission is to power the financial future through fault-tolerant, intelligent, and fully compliant ecosystems that help banks operate with absolute confidence.

We don’t just host banking workloads, we help institutions safeguard their digital trust.

To learn how we can strengthen your banking infrastructure, contact us today and explore what resilience truly means in action.

Rahul Dhar President - Global Datacenter Operations, CtrlS Datacenters

With nearly two decades of leadership experience leading critical infrastructure and technology teams, Rahul Dhar brings a deep understanding of managing and scaling mission-critical datacenter operations. At CtrlS, Rahul leads the company’s global operations charter. He is also responsible for ensuring operational resilience and reliability, improving uptime and recovery, and coordinating across infrastructure, facilities, and support functions to maintain the highest standards of service quality across CtrlS’ expanding global footprint. He recently served as the Country Director - Datacenters at Microsoft India. Previously, he has held senior leadership roles at Tata Communications, COLT, and Vodafone, where he led cross-geographic teams, delivered large-scale programs, and drove major process transformations across global operations.