Why Continuity Matters in Banking

In today’s financial landscape, continuity is currency.

Every transaction, login or loan application rests on that one single invisible promise – that banking systems will work all the time. Even a few minutes of downtime can erode customer confidence, invite regulatory scrutiny, and cause lasting reputational and financial damage.

For banks, resilience is a strategic imperative. The modern banking ecosystem thrives on uninterrupted service. That’s why the best-run institutions no longer treat continuity as a backup plan but as a core design principle.

From Principle to Practice: Continuity in Action

While the theory of resilience is well understood, its real power lies in execution. Across India’s financial landscape, banks of all sizes – from legacy leaders to agile new entrants – are transforming their operations by leveraging Rated-4 infrastructures to turn continuity into competitive advantage.

Banks today have unique challenges: compliance demands, scaling limits, modernization needs, or sustainability goals. Yet, the goal always remains the same – uninterrupted banking, delivered through sustainable and dependable infrastructures.

Let’s explore how four distinct financial institutions achieved resilience by design.

1. Strengthening Continuity for a Leading Private Bank

When a leading private-sector bank faced mounting regulatory pressure to strengthen its business continuity posture, its legacy setup posed challenges. RBI directives required an independent data center aligned with strict risk management mandates – one that could be deployed quickly, remain compliant, and scale effortlessly.

The bank’s partnership with CtrlS was truly transformative. CtrlS designed and deployed a Rated-4 colocation environment with 200 high-density racks, dual power feeds, and round-the-clock support. Within just a week, the facility was operational with multi-zone security, dedicated BCP cabins, and ISO-certified infrastructure.

The impact was immediate: the bank achieved 99.995% uptime, ensured 24×7 network availability, and realized significant cost efficiencies by eliminating recurring maintenance overheads. What began as a compliance requirement evolved into a foundation for digital agility – proving that continuity can be a competitive differentiator when built on the right infrastructure.

2. Building a Disaster-Ready Backbone for a National Banking Leader

A public-sector banking giant needed a resilient disaster recovery (DR) setup that could support one of the largest financial ecosystems in the country. The bank’s mandate: establish a fault-tolerant environment compliant with RBI standards – one that could go live swiftly and manage the scale of its nationwide operations.

CtrlS delivered a 500-rack, six-zone secure DR facility built on Rated-4 architecture. Dual-active power systems, precision cooling, and 100% network redundancy ensured uninterrupted uptime. Beyond infrastructure, CtrlS’ proactive monitoring and rapid support framework redefined operational efficiency.

The result was a disaster-ready colocation site capable of sustaining continuous service delivery and zero data loss – even during planned maintenance. The bank’s compliance audits transitioned from reactive to effortless, while the DR site became an operational extension of its primary systems, guaranteeing unbroken continuity and regulatory confidence.

3. Modernizing Infrastructure for a Fast-Growing New-Age Bank

A next-generation private bank, born from a mission of financial inclusion, faced new scalability challenges as it expanded nationwide. Post-acquisition growth and increasing data volumes demanded a stronger IT backbone – one that could ensure data residency, compliance, and cyber resilience without compromising agility.

CtrlS implemented a Rated-4 data center environment purpose-built for continuous availability. Data encryption, masking, and privacy-by-design controls fortified compliance readiness, while fault-tolerant systems ensured zero downtime and zero data loss during migration.

The transformation empowered the bank with 99.995% uptime, 100% compliance adherence, and enhanced cyber resilience. With operations now running on a secure, always-on foundation, the bank could scale its customer-first digital initiatives confidently by bringing last-mile banking services closer to millions across India.

4. Future-Proofing Data-First Growth for a Century-Old Institution

A legacy commercial bank, nearing its centenary, recognized the need to evolve its on-premise infrastructure to match modern digital demands. Frequent outages, limited scalability, and high power dependency risked slowing its data-first strategy.

Partnering with CtrlS, the bank undertook a “Lift & Shift” migration to a sustainable, Rated-4 colocation facility – completed in nearly half the planned time. The move provided fault-tolerant power, intelligent cooling, and 24×7 expert support, enabling the bank to focus on innovation rather than infrastructure management.

Today, it operates on a dependable, eco-efficient platform with the industry’s lowest PUE (Power Usage Effectiveness), translating to lower costs and reduced carbon footprint. What began as a migration has become an enabler of modernization. The bank now seamlessly supports digital banking, analytics, and customer-centric innovation on a continuously available, scalable backbone built to last another century.

What These Success Stories Reveal

Each of these institutions began from a different point – compliance, continuity, modernization, or scale – yet converged on the same outcome: uncompromised uptime, audit-readiness, and operational confidence.

These stories collectively demonstrate how CtrlS helps financial institutions shift from redundancy to true fault tolerance. By embedding continuity into every layer, whether it is infrastructure, operations, and monitoring – CtrlS ensures that resilience is not an afterthought, but a built-in advantage that fuels innovation.

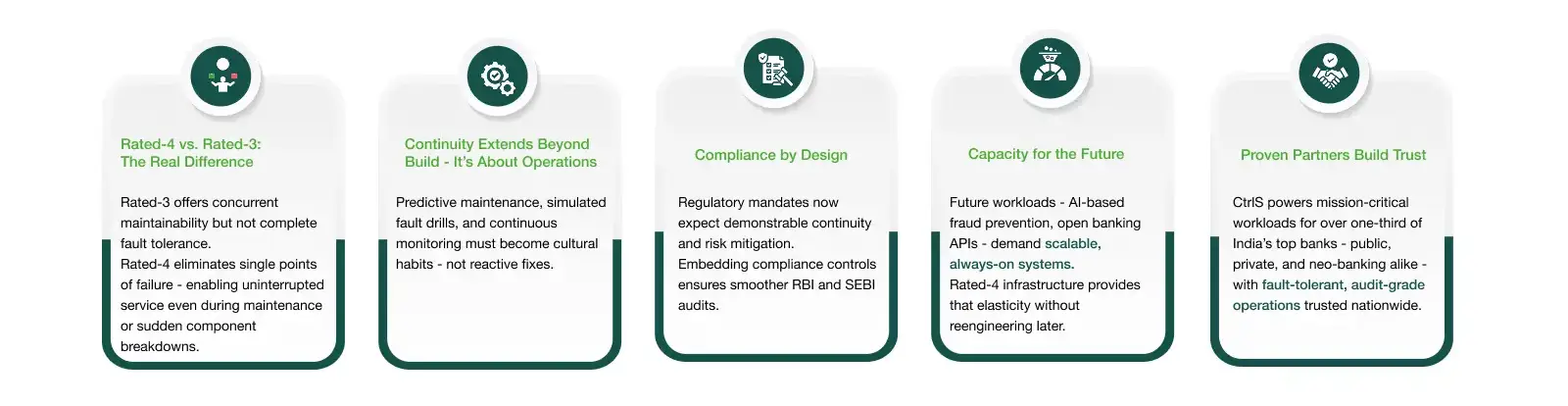

Key Takeaways for CIOs: Building Resilient, Future-Ready Banking Infrastructure

In banking, uptime is a strategic advantage for winning customer trust. The right infrastructure and operational mindset can transform continuity from a risk to a differentiator.

To stay ahead, proactive organizations concentrate on these critical areas:

Concluding Note

Customers measure trust in seconds – and regulators measure compliance in uptime decimals. Rated-4 infrastructure is the operational baseline for modern banking.

By adopting fault-tolerant, audit-ready architectures, banks can secure their systems, ensure resilience, and unlock agility for next-generation digital growth.

CtrlS continues to set this standard – enabling institutions to move beyond redundancy and achieve true fault tolerance that meets the demands of India’s 24×7 banking ecosystem.

Explore how CtrlS empowers India’s leading banks with resilient data center ecosystems and Rated-4 continuity: ctrls.com

Ashok Mysore - President – Sales (Data Center Business) CtrlS Datacenters.

A seasoned strategist and results-driven leader, Ashok has led high-performing sales teams and driven exponential revenue growth for global enterprises. Recognized for his clarity of thought, communication excellence, and people-first leadership, he continues to build meaningful partnerships that shape the future of digital infrastructure.