When you swipe your card or transfer money via UPI, you expect it to work every single time and within micro milliseconds. Behind that seamless experience lies a complex network of systems that the banking and associated ecosystem can never afford to fail.

In banking, even a few seconds of downtime can translate to millions in losses, in some cases, over $5 million an hour, and the reputational damage can be far greater not only for the bank but for consumers and nation as a whole.

This is why redundancy has become a necessity. Here is where Datacenters come into picture to guarantee reliability of a bank’s digital infrastructure.

In this blog, we will break down Rated-4 vs. Rated-3 datacenters, what redundancy truly means, and why financial institutions cannot afford to compromise on DC design for continuity.

The Banking Imperative: Why Uptime = Trust

Every transaction from a UPI payment to an instant credit check is a moment of trust between a customer and their bank. That trust is built on one non-negotiable expectation: everything must work, every single time and extremely fast.

In financial services, downtime is also a reputational, regulatory, and financial event. A one-hour outage during peak UPI volumes (sometimes with over 700 million transactions in a day) * can translate into crores of failed payments, regulatory penalties, and shaken customer confidence.

The Reserve Bank of India’s Master Direction on IT Governance and Business Continuity, along with IRDAI and NPCI mandates, now requires institutions to demonstrate uninterrupted service delivery and tested recovery plans. For banks, resilience is no longer an operational aspiration; it is a compliance obligation and a brand promise.

Rated-3 vs. Rated-4 Explained

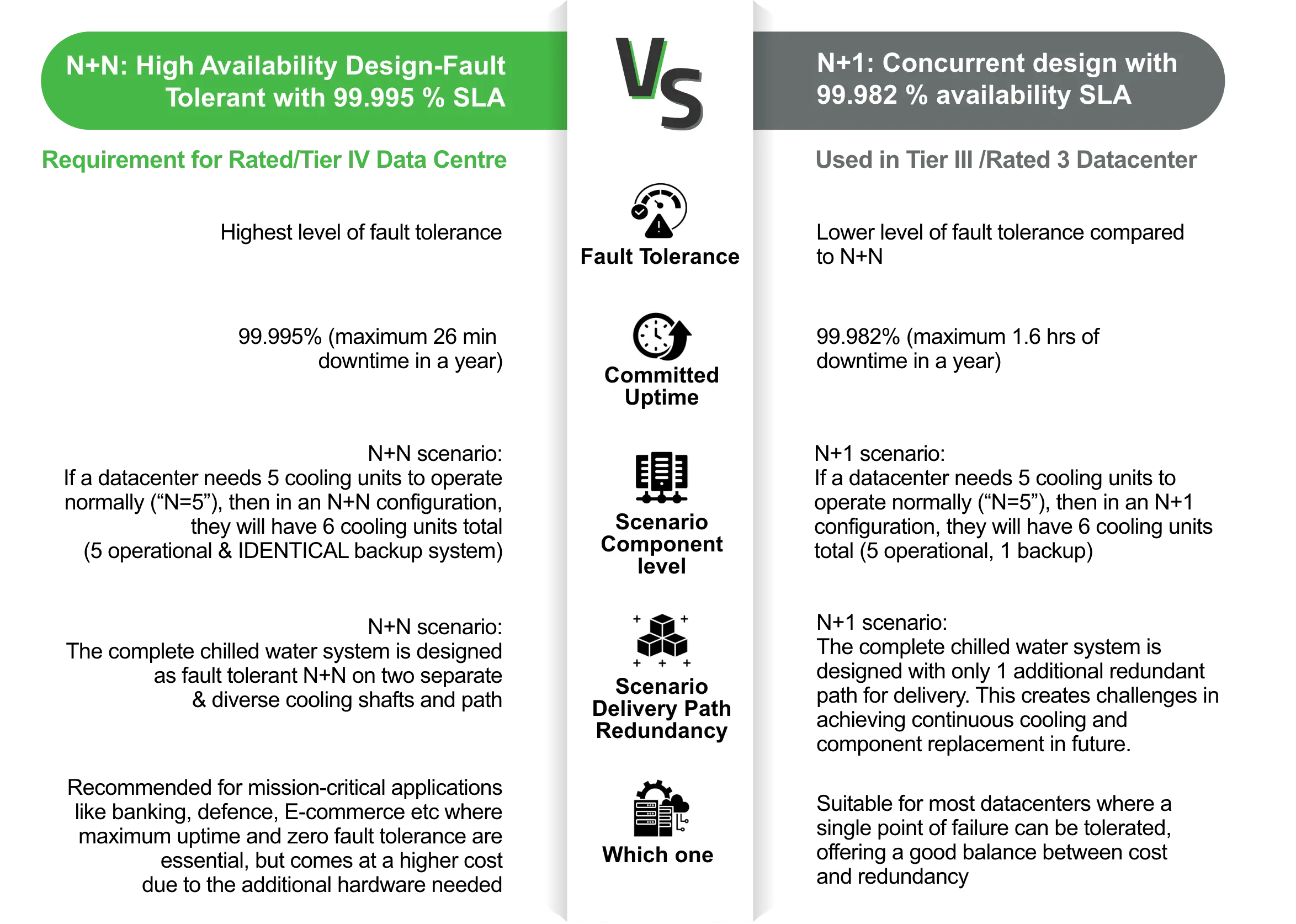

The Rated Classification system, defined under the TIA-942 standard, evaluates a datacenter’ s resilience, fault tolerance, and ability to maintain continuous operations under both planned and unplanned events.

Unlike general availability claims, these ratings certify the actual built infrastructure, covering power paths, cooling systems, electricals, network connectivity, and architectural redundancy.

At its core, the difference between Rated-3 and Rated-4 lies in how each handles failure and maintenance:

In essence, Rated-3 reduces risk, while Rated-4 eliminates it. The Rated-4 classification represents the gold standard for operational resilience and business assurance.

Why Rated-4 Redundancy Matters for Banks

In a Rated-4 datacenter, this is achieved through N+N or 2N+1 architecture, ensuring total isolation between redundant systems.

For banks, this design guarantees business continuity under every possible stress scenario.

1. No Tolerance for Downtime

Banking workloads demand continuous availability (99.995%). Payment rails, ATMs, mobile banking, and core systems run on clusters of servers and databases that must always be reachable. Rated-4 datacenters provide dual power distribution paths, independent UPS systems, and redundant cooling loops so maintenance or hardware failure never disrupts live services.

With real-time failover mechanisms and hot standby systems, transactions continue without interruption, even during component isolation or grid instability.

2. Compliance Readiness

Chapter III of the RBI’s Master Direction on IT Governance, Risk, Controls, and Assurance Practices (2023) emphasizes operational resilience and BCDR testing. Rated-4 infrastructure simplifies audit readiness by inherently meeting RBI, IRDAI, and NPCI standards for fault tolerance, recovery, and uptime assurance. The regulator has themselves built a Rated 4 DC and doing “walk-the-talk”.

Redundancy across compute, network, and power layers ensures banks can demonstrate compliance with Recovery Time Objectives (RTOs) and Recovery Point Objectives (RPOs) mandated in risk frameworks.

3. Resilience Under Stress

A Rated-4 environment can withstand simultaneous equipment failures and external disruptions such as cyberattacks, power grid outages, or natural disasters. Each critical subsystem (from generators to fibre links) operates in isolated electrical and mechanical paths.

Automated failover and intelligent monitoring systems detect anomalies in real time, rerouting traffic or switching power sources within milliseconds. This ensures that no single fault propagates into a service outage.

4. Future-Ready Infrastructure

Modern banking workloads like AI-driven credit scoring, real-time fraud analytics, and CBDC transaction processing require uninterrupted high-performance computing. Rated-4 datacenters with dual active power and cooling systems support these compute-intensive operations under sustained load. Their architecture supports scalable high-density racks, edge interconnects, and multi-cloud connectivity, ensuring banks can expand securely as digital infrastructure evolves.

As Asia’s largest network of Rated-4 datacenters, CtrlS offers true end-to-end redundancy, from power and network to cooling and storage. With zero single points of failure, continuous monitoring, and industry-best uptime SLAs, CtrlS allows banks to deliver always-on digital services that meet both regulatory expectations and customer trust benchmarks.

Why CtrlS Is the Preferred Data Center Partner for Banks

Choosing a datacenter provider is a strategic decision for any bank. Beyond uptime, institutions must evaluate resilience, efficiency, sustainability, customizations, and domain expertise. CtrlS sets the benchmark across all five, offering infrastructure designed specifically for mission-critical banking environments.

1. Largest Network of Rated-4 Facilities

CtrlS operates the largest pool of Rated-4 datacenters in India, ensuring redundancy and zero single points of failure. This architecture guarantees continuous availability even during maintenance or system outages, a crucial factor for payment networks, trading platforms, and digital banking systems that must remain always-on.

2. Proven Banking Expertise

With a track record of serving >50 Global and Domestic banks, including 11 of India’s top 20, CtrlS understands the operational, security, and compliance expectations of the financial sector. They are designed, operated by in-house experts, and audited by independent 3rd part agencies to meet stringent RBI, IRDAI, and NPCI frameworks, ensuring complete regulatory alignment.

3. Sustainability and Energy Efficiency

CtrlS delivers the industry’s lowest Power Usage Effectiveness (PUE) of 1.4, maximizing energy efficiency without compromising performance. Its GreenVolt initiative integrates renewable power and intelligent cooling, helping banks meet both ESG and cost-optimization goals. We are also helping and guiding some of the Top 100 listed customers in sharing our knowledge to helping them script the doable, processes to meet the mandated compliances.

4. Custom-Built Banking Infrastructure

Through Bank-in-a-Box solutions, CtrlS provides modular, pre-validated environments that meet the specific needs of banks — from core banking systems to digital currency infrastructure. The result: faster deployment, predictable performance, and built-in compliance.

Key Learnings & Action Points for CIOs and Technology Leaders

- Build for Fault Tolerance, Not Maintenance

Rated-3 enables maintainability; Rated-4 ensures complete fault tolerance. For always-on banking systems, design should start with the assumption that failure will happen — and operations must continue seamlessly. - Integrate Compliance into Architecture

Audit readiness is not a post-launch checklist. RBI and SEBI frameworks now expect compliance to be built into architecture — from dual power paths to monitored DR drills. - Use AI for Predictive Operations

AI-enabled monitoring can forecast failures in cooling, UPS, or network layers before they occur. Moving from reactive maintenance to predictive resilience ensures uninterrupted service delivery. - Prioritize Visibility Across Systems

A unified BMS and DCIM view provides real-time visibility across power, cooling, and IT infrastructure — essential for quick remediation, regulatory reporting, and capacity planning. - Align Resilience with Sustainability

Low PUE, renewable power, and optimized cooling are not just ESG goals — they directly impact long-term operational efficiency and cost predictability. - Choose Partners Who Understand Banking DNA

Not all uptime is equal. Choose providers that combine technical capability with experience in regulatory audits, financial workloads, and operational rigor.

Takeaway: The Default Choice for Banking Continuity

Banking runs on trust, and uptime plays a crucial role in it. In a world where even milli second of disruption can cost crores and credibility, Rated-4 infrastructure is not a luxury but a necessity in the country today. Rated 4 DC infra led by CtrlS also augurs the position of our nation on architectural and uptime excellence amidst growing competition from rising economies of APAC in attracting IT and DC investments for real time applications and AI workloads It is the difference between operational resilience and operational risk. For institutions that cannot afford to go offline, the choice is clear.

Discover how CtrlS ensures uninterrupted banking continuity with India’s largest Rated-4 datacenter footprint.

Dharmendra Singh, VP - Hyperscale Business & Large Accounts, CtrlS Datacenters

Dharmendra is a seasoned expert in hyperscale and enterprise Datacenter Build-to-Suit (BTS) and hosting solutions. He leads initiatives that bridge collaborations with hyperscale service providers, large enterprises, government entities, and OEMs, driving innovative solutions that address the evolving IT infrastructure landscape. With a deep focus on customer engagement and architecture optimization, he ensures seamless transitions across on-premises, colocation, cloud, and hybrid environments. Committed to delivering customer success, he emphasizes network redundancies, cost-effective strategies, and operational efficiency, enabling organizations to realize their strategic objectives and maximize value from their IT investments.