Global BFSI IT spend is projected to exceed $761 Billion in 2025. Yet despite these massive investments, CFOs still rank “unpredictable cloud costs” among their top concerns – and for good reason.

As the sector accelerates its digital transformation, the very infrastructure meant to enable agility and innovation is becoming a liability. Rising cloud demands, mounting compliance requirements, and fragmented multi-cloud environments are straining IT teams and budgets alike.

One misstep, such as an over-provisioned workload or a misconfigured instance, can result in six-figure bills within days. But there is a better way. This blog explores how BFSI organizations can take control of cloud spend while ensuring uptime, security, and compliance without compromise.

Why Cloud Optimization Is a Boardroom Priority in BFSI

Cloud is no longer just an IT decision — it’s central to business performance. Core banking now runs in real time. Mobile apps have effectively replaced branches, handling onboarding, transactions, and investments. Today, 91% of financial institutions use cloud services, with many adopting multi-cloud setups to boost resilience.

What began as a cost-saving initiative has evolved into a strategic differentiator. Cloud-native banks launch products faster. Insurers use predictive analytics to streamline operations. Fintechs outpace incumbents with agile, data-driven services.

Are BFSI Firms Realizing Full Value from Cloud?

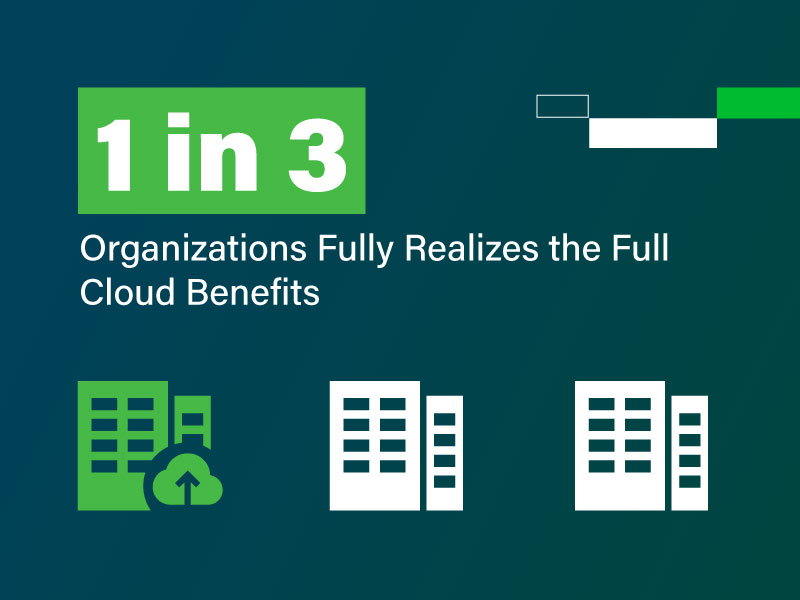

Despite the adoption, only 1 in 3 organizations fully realizes the full cloud benefits. Multi-cloud setups often create silos, with teams spinning up resources across platforms without clear governance. The result? Rising costs, inefficiencies, and missed opportunities.

What’s Behind the Multi-Cloud Cost Control Crisis?

According to IDC, more than 75% of BFSI firms now operate across multiple cloud providers. But instead of delivering flexibility, this often adds complexity. Each provider comes with its own pricing models, tools, and governance requirements — making unified cost visibility and control nearly impossible.

Top 3 Challenges in Multi-Cloud BFSI Environments:

- Inconsistent billing and lack of cost tracking

- Security and compliance gaps across platforms

- Redundant or underutilized resources inflating spend

The New Trinity: Why Traditional IT Metrics Aren’t Enough

In today’s BFSI landscape, success hinges on three pillars: Uptime, Trust, and Cost Control.

- Uptime means delivering consistent, high-performance systems – even during peak demand.

- Trust requires airtight security, regulatory compliance, and data sovereignty.

- Cost Control demands real-time visibility and intelligent optimization across environments.

In a sector defined by strict oversight, cloud efficiency is no longer optional – it’s a competitive edge.

Compliance and Security in a Zero-Margin-for-Error Industry

In 2024, global penalties reached a record-breaking $19.3 billion. The message is clear: compliance isn’t optional, and the penalties for getting it wrong are escalating exponentially.

Navigating The Regulatory Maze

BFSI firms operate within a complex web of compliance requirements.

The Expensive Safety Net Syndrome

To avoid compliance pitfalls, many firms default to overprovisioning. Redundant backups across multiple regions, always-on monitoring systems, and duplicate compliance infrastructure. While this approach minimizes regulatory risk, it creates a new problem, cloud bills that spiral out of control, often consuming 40-60% more resources than operationally necessary.CtrlS: Compliance Without Cost Creep

Amidst the rising cost of non-compliance, CtrlS Cloud Optimize helps organizations meet regulatory demands without bloating budgets.- Policy-driven storage and backups ensure compliance is built-in, not bolted on

- Region-based data handling guarantees localization without duplication

- Real-time audit trails and secure tagging provide visibility, accountability, and optimal resource use

Why Resilience is Non-Negotiable in Financial Services

In the BFSI world, trust and uptime are everything. System availability isn’t just an IT metric — it defines market position, customer confidence, and business continuity. Resilience, therefore, is not a nice-to-have; it’s mission-critical.When Milliseconds Mean Millions

In financial services, there’s no such thing as “acceptable downtime.” If UPI transactions do not process within 500 milliseconds, customers abandon the payment. HFT algorithms execute thousands of trades per second, where a 10-millisecond delay can mean the difference between profit and loss. These are business-critical functions where performance directly impacts revenue. When the core banking system processes over 20 million daily transactions during peak periods, every second of latency multiplies across millions of operations.The Real Cost of Cloud Fragility

Cloud outages don’t just cause downtime. They also carry steep financial, regulatory, and reputational consequences:- Financial losses: Missed fees, abandoned transactions, and lost acquisition spend

- Regulatory penalties: Non-compliance with uptime mandates results in fines and audits

- Reputation damage: Customers quickly lose trust and switch to competitors

- Market impact: Major outages have erased hundreds of millions in market value

Cloud Spend Is the New Risk on the Balance Sheet

Cloud costs have quietly become one of the biggest threats to financial stability in BFSI. The issue? Lack of visibility and control. Fragmented multi-cloud environments make it nearly impossible to track spending accurately. Finance teams are buried under inconsistent invoices, while business units spin up overlapping workloads — from fraud analytics to customer experience models — creating unpredictable cost spikes.CtrlS Cloud Optimize: Built for BFSI Complexity

Generic cloud optimization tools treat all industries the same, applying one-size-fits-all approaches that miss the nuanced requirements of financial services. CtrlS Cloud Optimize is designed specifically for the regulatory, operational, and performance demands that define BFSI success. From core banking transaction patterns to insurance claims processing workflows, every optimization algorithm understands the mission-critical nature of financial workloads and the zero-tolerance environment in which they operate. CtrlS Cloud Optimize helps BFSI organizations take back control – turning cloud chaos into strategic advantage. It delivers:- Unified Cost Visibility across AWS, Azure, Google Cloud, and private environments

- Intelligent Right-Sizing that automatically scales down underutilized resources in real time

- Role-Based Controls & Automated Chargebacks to enforce accountability and align spending with business units

- Predictive Scaling that anticipates demand and prevents bottlenecks before they occur

- Smart DR Provisioning that maintains readiness without excessive replication

- Proactive Monitoring to detect and resolve risks before they impact availability

Key capabilities that set CtrlS apart:

- BFSI-Native Architecture: Purpose-built for banking, insurance, and fintech workloads with optimization patterns that respect regulatory requirements and performance SLAs

- True Hybrid Optimization: Seamlessly manages and optimizes across cloud, on-premises, and private cloud environments through a single control plane

- Enterprise Optimization Framework: Advanced chargeback mechanisms, real-time anomaly detection, and granular budgeting controls that align with corporate financial planning cycles

- 24/7 Expert Support: Dedicated teams with deep BFSI domain expertise who understand that uptime requirements and security protocols are non-negotiable

- Innovation Without Risk: Enables rapid scaling of AI initiatives, automation platforms, and digital services while maintaining cost predictability and regulatory compliance throughout the deployment lifecycle

Conclusion: Optimize for Trust

In financial services, trust is the fundamental currency that drives every customer interaction, regulatory relationship, and market position. This trust rests on three unshakeable pillars: uptime, compliance, and disciplined cost management that demonstrates operational excellence and sustainable growth. The digital transformation imperative hasn’t diminished these requirements; it has amplified them. As BFSI organizations race to deploy AI-powered experiences, the complexity of maintaining trust while innovating has also increased. CtrlS Cloud Optimize allows financial institutions to deal with this complexity with confidence, delivering breakthrough innovation. All of this while maintaining the accountability standards that define industry leadership. The leaders of tomorrow’s BFSI Industry will be those who optimize early and scale securely. Get in touch to optimize your cloud!

Ankush Bansal, Senior Vice President - Presales, CtrlS Datacenters

With over 20 years of rich experience in presales and solution design, Ankush is a seasoned expert driving large-scale IT, cloud, and datacenter transformations. Skilled in leading C-level engagements, AI OPS-driven managed services, and complex enterprise transformation across BFSI, manufacturing, government, and more, Ankush has a proven track record of delivering cutting-edge solutions in cloud, cybersecurity, networking, and hyperscale infrastructure.